Canadian demand for U.S. real estate is slipping, and the catalyst is clear: Washington’s firm stance on trade.

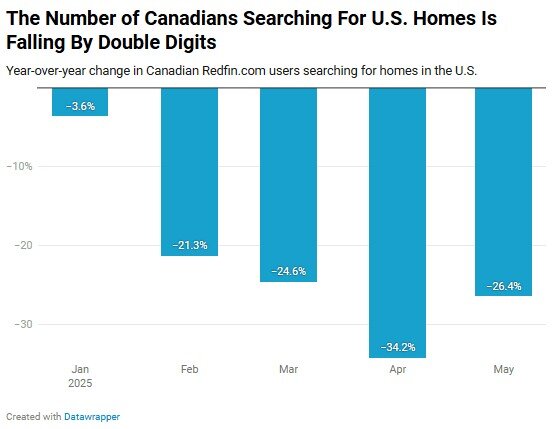

Searches by Canada-based users on Redfin.com for U.S. homes dropped 26.4% year-over-year in May 2025, according to a new report from the tech-enabled brokerage. The pullback comes after the White House imposed 25% tariffs on Canadian and Mexican imports earlier this year–part of a broader policy to reset decades of lopsided trade with America’s northern neighbor.

While the tariffs sparked tensions, U.S. officials say the goal is long overdue: leveling the playing field after years of American trade deficits and industrial erosion. Canadian interest in U.S. housing began tapering in February, when the first wave of tariffs hit. By April, after a broader global tariff rollout, Canadian searches for U.S. homes had plunged 34.2% year-over-year.

“We’re seeing less Canadian capital flow into the U.S. housing market–and that reflects a needed correction,” said one senior U.S. trade official familiar with the matter. “We’ve sent a clear signal: fair trade first.”

The data backs that up. While overall traffic on Redfin.com fell only modestly, the sharp Canadian drop suggests a direct response to the tariffs and shifting geopolitical winds. At the same time, Washington has shown little interest in walking back its hardline posture. Current negotiations remain tense, with Canadian leaders pushing back against U.S. efforts to renegotiate key sectors, from lumber to energy.

“Normally I work with five or more Canadian buyers each spring,” said Heather Mahmood-Corley, a Redfin Premier agent in Phoenix. “This year, there were none. Instead, I helped a Canadian sell. Some are clearly nervous about the political climate, but it’s also a sign that American policy is having real impact.”

For years, Canadian investors have dominated U.S. international homebuying, accounting for 13% of foreign purchases in 2024 and spending $5.9 billion–often in sunbelt states like Florida and Arizona. That flow is now reversing, particularly in metro areas that previously saw high demand: Houston saw Canadian searches drop 55.2%, followed by Philadelphia (-53%) and Chicago (-47%). Even popular retirement markets saw declines, including Miami and Orlando (down ~30%), Phoenix, and Palm Springs (each down 23%).

Some in the U.S. real estate sector may feel the effects in the short term. But from a macro perspective, the shift represents a broader reshoring effort aimed at strengthening domestic industry, protecting U.S. jobs, and reasserting economic sovereignty.

And it’s not just politics. A weaker Canadian dollar (CAD), tighter financial conditions, and increased homeownership costs in the U.S. are making purchases less attractive to foreign buyers. Add in President Trump’s remark earlier this year about making Canada the “51st state,” and some Canadians are simply choosing to sit out–for now.

“I haven’t worked with a Canadian buyer in over a year,” said Marsha McMahon-Jones, a Redfin Premier agent in Palm Springs. “Most are taking a wait-and-see approach. They’re not selling, but they’re not buying either.”

In markets like Florida, Phoenix, and Riverside, the retreat coincides with a broader slowdown driven by high insurance premiums and climate risk–pressures impacting Americans and foreign buyers alike.

But while fewer Canadians shopping for U.S. homes may rattle some agents, others view it as part of a necessary recalibration. In a moment where American policymakers are prioritizing domestic strength and economic self-reliance, the cooling of cross-border real estate may be a small price to pay.