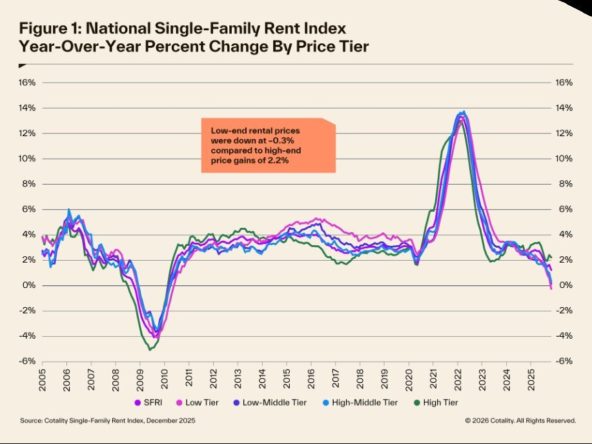

Rents for both multifamily and single-family built-to-rent units moved sideways over the last year. Still, rents in most major Sun Belt markets are down annually due to a glut of new housing, according to the latest Yardi Matrix National Multifamily Report.

Meanwhile, rental growth is typically the strongest in the Midwest, Northeast, and California. This mirrors trends in the for-sale market, as markets with negative home price appreciation over the last year tend to be concentrated in the Sun Belt and the Mountain West.

Built-to-rent rental rates fall for the fourth straight month

Advertised rental rates for single-family built-to-rent (BTR) properties fell $10 to $2,185 in November, and are down for the fourth straight month, or $28 from the July peak.

On a national level, BTR asking rents are down 0.5% year-over-year, a notable reversal from November gains of 1.4% in 2023 and 2024. This signals a slowdown in the BTR market, but there are dramatic regional differences: the Midwest was a strong point, while the Sun Belt posted the most significant declines.

The Twin Cities and Chicago both experienced rental growth of 7.9%, while Grand Rapids posted 4.9%. Meanwhile, BTR asking rents in the Austin (-3.9%), Charleston (-3.8%), and Pensacola, Fla. (-2.5%) markets fell the most.

Meanwhile, national occupancy remained relatively flat at 95%, increasing just 0.1% year-over-year.

Multifamily rents fell the most in the Sun Belt

National multifamily asking rents grew 0.2% year-over-year, but fell $8 last month. However, noteworthy regional differences abound. Markets in the Northeast, Midwest, and California typically experienced gains, while the Sun Belt and Mountain West regions faced the most difficulty.

Asking rents grew annually the most in New York (5.7%), Chicago (3.8%), Twin Cities (3.2%), San Francisco (2.6%), and Kansas City (2.2%), and declined the most in Austin (-5.0%), Denver (-4.1%), Phoenix (-4.1%), Las Vegas (-2.1%), and Dallas (-2.0%).

Providing a strong clue as to why regional rent trends vary so profoundly, the report also found that the markets with the highest percentage of new multifamily inventory experienced negative rent growth. There were seven markets, all in the Sun Belt, where at least 5% of the total multifamily stock was completed in the last year, led by Austin (8.6%) and Charlotte (7.4%).

“Advertised rents have been negative for a year or more in metros such as Austin, Denver, Phoenix, and Dallas that are dealing with a glut of supply that has lowered occupancy rates despite strong absorption,” the report read.

November was a difficult month for multifamily rents nationally, as only the Twin Cities metro posted positive monthly rent growth. The report also found that the number of apartment units absorbed in October was the lowest in several years, a warning sign that there isn’t enough demand to match the amount of new supply, particularly in the Sun Belt.

“While negative rent growth has recently been led by high-supply markets, this month’s declines were broad-based and somewhat unexpected.”

Multifamily developers have clearly responded to this glut of new supply by pulling back on new construction. Data from the Federal Reserve Bank of St. Louis reported 403,000 housing starts in buildings with 5 units or more, down more than 34% from a November 2022 peak of 615,000.

Rent growth could be muted in the months ahead

Winter months are historically weaker for rent growth. However, the report also forecasted that rents could be muted for the foreseeable future amid a sustained delivery pipeline, weak consumer confidence, and slowing job growth.

The OECS’s consumer confidence index was at 98.46 as of October, lower than the long-term average of 100. The job market has also raised concerns. While the government shutdown delayed official government job reports for October and November, an ADP report found that private-sector employment in November declined by 32,000 jobs.

The report also said that declining immigration rates could hamper multifamily rent growth. Pew Research found that the nation’s foreign-born population declined by more than 1 million people between just January and June, the most significant drop since the 1960s, and further deportations and restrictions on legal immigration have continued since.