Согласно новым данным компании Cotality, долгожданный приток жилья, ожидаемый в связи со старением населения Америки, происходит гораздо медленнее, чем предполагалось на рынке недвижимости ранее.

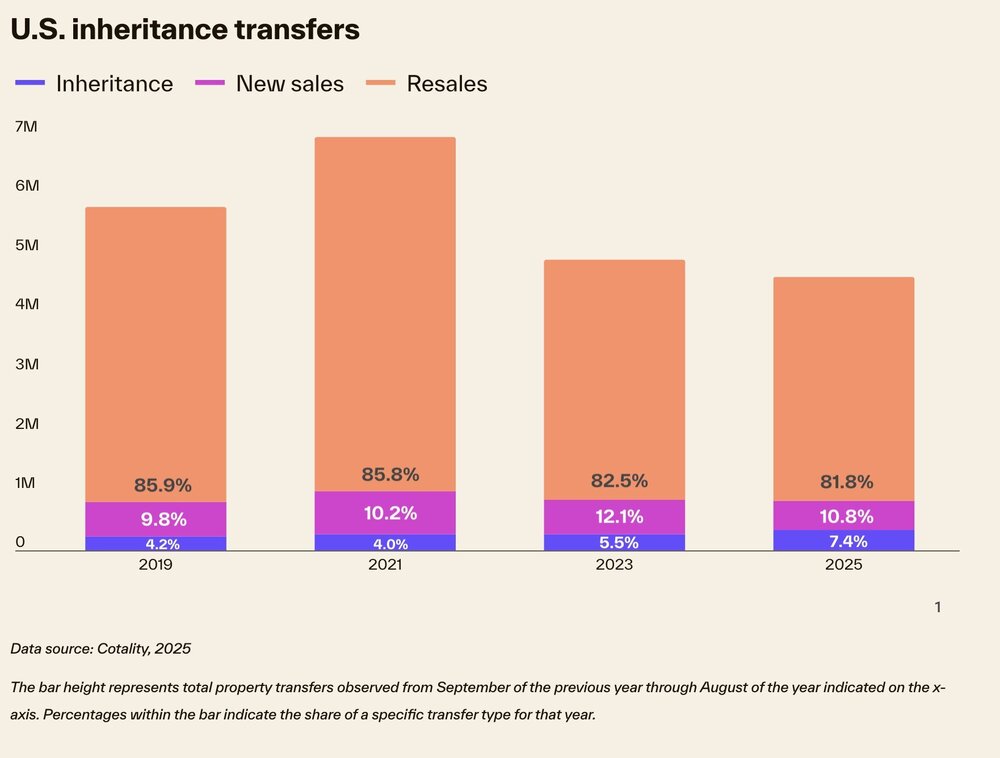

Согласно данным Cotality, за 12 месяцев по август 2025 года в США было передано по наследству рекордное количество домов – 340 000. Хотя это исторический максимум, на долю таких объектов недвижимости пришлось всего 71 000 от всех сделок с жилой недвижимостью по всей стране, что подчеркивает, насколько мало предложения фактически поступает на открытый рынок, поскольку активность на вторичном рынке продолжает снижаться.

В течение многих лет экономисты, специализирующиеся на рынке жилья, утверждали, что старение поколения бэби-бумеров вызовет «серебряное цунами» предложения жилья, снизив давление на доступность за счет увеличения количества домов, поступающих в обращение. Однако результаты исследования Cotality показывают обратное: пожилые люди дольше сохраняют свои дома, и все большая доля недвижимости вообще не выставляется на рынок.

Нигде это не проявляется так наглядно, как в Калифорнии. По данным Cotality, в 2025 году почти 60 000 домов в штате были переданы по наследству, что составляет около 181 000 от всех сделок с недвижимостью. Впервые количество домов, переданных по наследству в Калифорнии, более чем вдвое превысило количество проданных новых домов за тот же период.

Государственная налоговая политика играет центральную роль. В Калифорнии ежегодное повышение налога на недвижимость ограничено примерно 21 миллионом долларов, независимо от роста рыночной стоимости, и эта налоговая база может быть передана детям и внукам на первые 1 миллион долларов оценочной стоимости, при условии, что наследник использует дом в качестве основного места жительства. В результате у наследников возникает сильный финансовый стимул переехать в этот дом, а не продавать его, что фактически сокращает потенциальное предложение на более широком рынке.

На национальном уровне рост числа наследственных прав может, казалось бы, подтверждать давнюю демографическую теорию. Однако более глубокий анализ данных переписи населения США, проведенный компанией Cotality, показывает, что ожидаемый всплеск предложения задерживается беспрецедентным уровнем старения населения, проживающего в своих домах.

Поколение бэби-бумеров — ныне самая многочисленная группа пожилых людей в истории США — владеет большим количеством домов, чем любое предыдущее поколение в сопоставимом возрасте. Согласно анализу данных переписи населения, цитируемому Cotality, американцы, родившиеся в 1948 году, к 65 годам владели примерно на 501 000 больше домов, чем те, кто родился всего десять лет назад.

Кроме того, вероятность переезда у них значительно снизилась. Более 221% домовладельцев, родившихся в 1938 году, покинули свои дома в возрасте от 65 до 75 лет. Для тех, кто родился в 1946 году, эта доля падает до 171%, что свидетельствует о структурном сдвиге в том, как долго пожилые американцы остаются в своих домах.

Последствия распространяются по всему рынку жилья. Проживание в собственном доме в пожилом возрасте замедляет традиционный цикл уменьшения площади жилья, перепродажи и реконструкции, задерживая высвобождение жилищного фонда и во многих случаях предотвращая его выход на рынок вообще. Вместо этого дома все чаще передаются напрямую от одного поколения к другому.

Для наследников наследование может стать редким облегчением в эпоху высоких цен и стоимости заимствований, особенно в штатах, где налоговые правила благоприятствуют долгосрочному владению. Однако для потенциальных покупателей эта тенденция приводит к сокращению предложения и затягивает решение проблем с доступностью жилья.

Вывод для политиков очевиден. Одних лишь демографических факторов недостаточно для решения проблемы нехватки жилья в Америке. Хотя наследование меняет модели владения жильем, оно не увеличивает предложение в масштабах, необходимых для восстановления баланса на рынке. Если доступность жилья должна улучшиться, решение остается тем же: строить больше домов.